“Year’s end is neither an end nor a beginning but a going on with all the wisdom that experience can instill in us.”

~ Hal Borland, American Writer (1900-1978)

- 2025 has come to a close with another strong market performance in most asset classes.

- Ongoing news flow, political shifts, technological advancement, policy change, economic volatility and much more marked a year which often appeared chaotic.

- For investors, it is once again time to look back and close the book on all facets of 2025 as we march forward into the uncertainty of 2026.

As the famous Times Square ball began to drop on December 31, 2024 at 11:59pm, Americans looked towards 2025 with mixed emotions; some with trepidation and others with optimism. A new President was weeks away from being inaugurated, the geopolitical temperature was simmering towards a boil, and the economic backdrop was being increasingly questioned with markets having seen several strong years in a row.

One year later, markets continued to prove their resiliency, and much of the uncertainty remains, arguably it has even increased. As we contemplate the year ahead, we celebrate pop culture, sports, music, policy changes, and all that made 2025 what it was including: Stranger Things finally concluding (no spoilers here), the finale to Wicked emerging as a box office favorite (as theatres try to hang on in an ever growing streaming environment), the Eagles soaring to victory in Super Bowl LIX, Oklahoma City winning the NBA Championship, the Dodgers adding another World Series, Kyle Larson steering to a second NASCAR Cup, and Rory McIlroy mastering Augusta. Beyonce took home Album of the Year, Taylor Swift continued to grow her iconic global status and artificial intelligence (“AI”) emerged in virtually every segment of our lives. The world enters another year with the risks and optimism that typically go hand in hand with the calendar turn, as we reflect on the year that was 2025.

News & Global Events

2025 was defined by sharp political shifts, persistent global tensions, and rapid technological change.

Donald Trump returned to the White House in 2025, becoming just the second president in U.S. history to be re-elected to non-consecutive terms – the last being Grover Cleveland in the late 19th century. President Trump entered office with a bold agenda, centered on reshaping international trade, rolling back regulation, and revisiting tax policy, alongside a more assertive approach to foreign affairs.

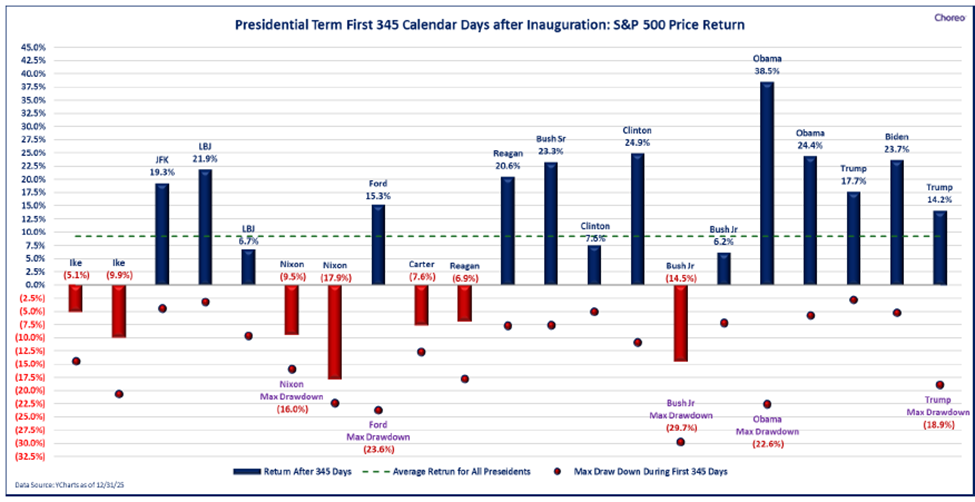

While trade reform was a core pillar of the campaign, few anticipated the speed and magnitude of change that would follow. With only a narrow Republican majority in Congress and midterm elections looming in 2026, the administration moved quickly, prioritizing executive action to push through tariffs and regulatory rollbacks that rapidly altered market behavior and global trade dynamics. For markets, as much as industry pundits would like to spread the message that performance is stronger for a particular party, the sample size is small, and typically the party in power is not directly to blame or credit. Policy changes will impact the real economy over longer periods of time. The chart below highlights the performance of the S&P 500 price return during the first 345 days of new Presidential Administration terms, and President Trump’s initial time in office for this second term saw markets behave relatively close to average.

Abroad, 2025 marked an inflection point as long-standing geopolitical lines were challenged and, in some cases, redrawn. Major U.S. allies – especially Germany – began shifting gears on its fiscal and industrial policies by bolstering defense spending, green energy transition capex, and digitalization efforts, reflecting a broader national security theme that increasingly values resilience over efficiency. At the same time, competition between the United States and China intensified, with artificial intelligence and natural resources emerging as a central battleground – one with economic, military, and strategic implications that could shape global leadership for years to come.

Meanwhile, generative AI continues to ramp and has begun penetrating various parts of life in 2025. To date, however, from a market perspective, the results have been more promise than payoff. While investment and experimentation accelerated, adoption was uneven and often confined to narrow use cases rather than true enterprise-wide transformation. Productivity gains proved incremental and difficult to measure, and in many cases the pace of enthusiasm ran ahead of practical implementation. At the same time, AI’s strategic importance continued to rise. Governments and corporations are increasingly framing AI as a long-term competitive advantage, elevating AI from a technology discussion to a policy one.

Economic Highlights

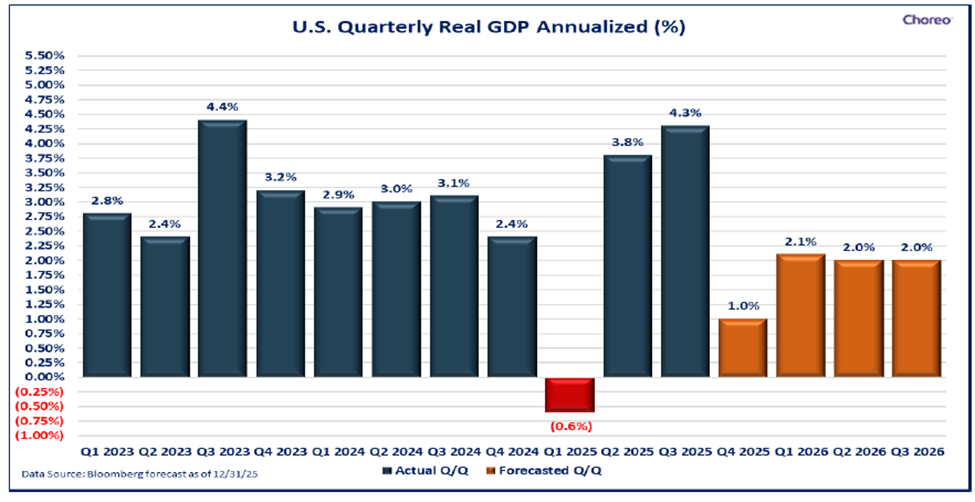

Following initial forecasts for weaker growth in the wake of shifting trade policy, the global economy in 2025 proved more resilient than many expects. Rather than a sharp downturn, most international agencies now project global GDP growth between 2-3%, supported by consumer demand, AI-related investment, and policy easing. In the U.S., after a slight contraction in the first quarter, economic activity rebounded through the middle of the year, with annualized GDP gains in the second and third quarters running ahead of expectations.

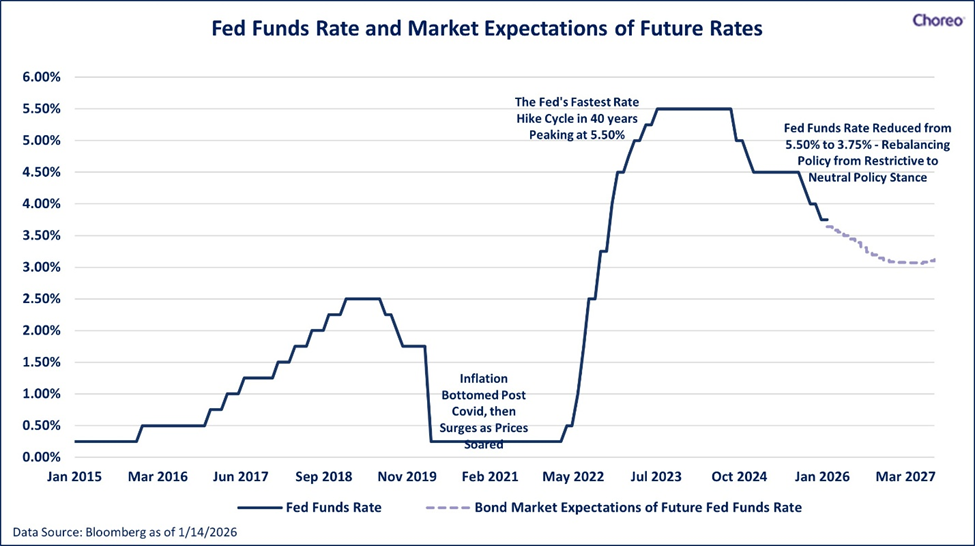

Inflation uncertainty remains a risk with Central Banks closer to a neutral stance. In the U.S. the Federal Reserve (the “Fed”), has now reduced rates by 1.75% from 5.5% to 3.75%, with two more rate cuts currently priced in for 2026. As is always the case, this is highly subject to change and will be data dependent.

Market Performance

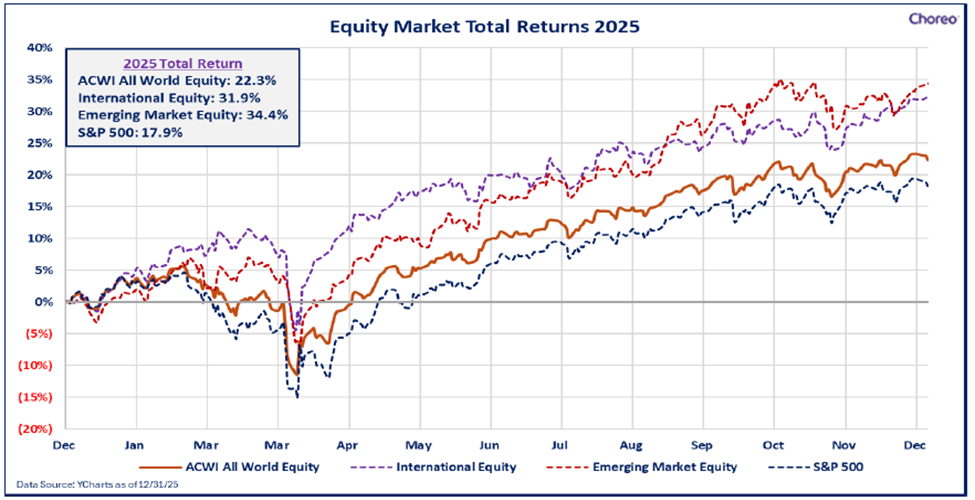

Asset-class returns in 2025 were broadly strong. Global equities performed well, with the All Country World Index (ACWI) - a benchmark including developed and emerging markets – posting solid gains for the year, led by strength outside the United States.

Bonds also contributed positively to portfolios, benefiting from moderating inflation and a more stable interest-rate backdrop. Even so, most asset classes struggled to keep pace with silver and gold – two yield-less commodities often seen as hedges against geopolitical risk and currency debasement. Bond markets have not had many down years in the last 25, but the last three years did show a healthy recovery following the rapidly rising interest rates seen in 2022 (and corresponding difficult price declines).

Conclusion

2025 was a year of change, a year of uncertainty and a year of both optimism and challenges. The investment universe handled these with resilience and enters a new year with momentum. As long-term focused investors, 2025 simply means a calendar flips, and we need to remember to write a “6” rather than a “5” when writing the date. The lessons learned reinforce the long-term focus and the history of 2025, while never to be precisely repeated, as is often said, can rhyme. We hope you are off to a good start in 2026 and please reach out to your Choreo advisor if you have any questions.

Disclosures

The performance numbers displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past performance does not indicate future results and investors may experience a loss. The indices discussed are unmanaged and do not incur management fees, transaction costs or other expenses associated with investable products. It is not possible to directly invest in an index.

Opinions are expressed as of the date indicated, are subject to change and are based on sources considered reasonable by Choreo.